Ethereum (ETH) is grappling with fading bullish power as its latest try and surpass vital resistance zones has faltered. Buying and selling at $3,119, the ETH token hovers just under its 100-day Easy Shifting Common (SMA) at $3,312, caught in a fragile consolidation part that would dictate its subsequent large transfer.

One-Day Chart Evaluation

In line with the each day chart evaluation, a notable effort was made to interrupt by the $3,500 resistance stage, the place key technical elements converged. This included the higher boundary of a symmetrical triangle sample and the 50% Fibonacci retracement stage at $3,517. But, the push was met with stiff promoting stress, forcing a retreat and leaving bulls unable to capitalize on the momentum.

Ethereum’s failure to take care of momentum above key resistance ranges has revealed weak spot in shopping for stress, triggering a corrective transfer to its present stage of round $3,119. At current, the $3,000 assist stage stands as a vital line of protection, offering stability amidst mounting bearish stress.

Nonetheless, ought to this assist break, the cryptocurrency dangers an extra drop towards $2,927, a pivotal Fibonacci retracement zone that would function a key battleground between bulls and bears. Such a breakdown would possible reinforce bearish sentiment, pushing the ETH token into deeper corrections and reshaping its short-term market trajectory.

On the upside, the 100-day shifting common (MA) acts as a formidable resistance, capping any bullish restoration makes an attempt so long as the ETH cryptocurrency trades under it. In the meantime, the symmetrical triangle sample on the chart provides a component of suspense, suggesting the prospect of a pointy and decisive transfer in both course.

A breakout above $3,500 might reignite optimism and open the door to increased value targets. Nonetheless, a breach under $3,000 may speed up promoting stress, leaving bulls on the defensive and probably tipping the steadiness in favor of bears. With the Ethereum token at a vital juncture, its subsequent transfer will possible outline the speedy market outlook, retaining merchants on edge.

Profitability and Transaction Evaluation

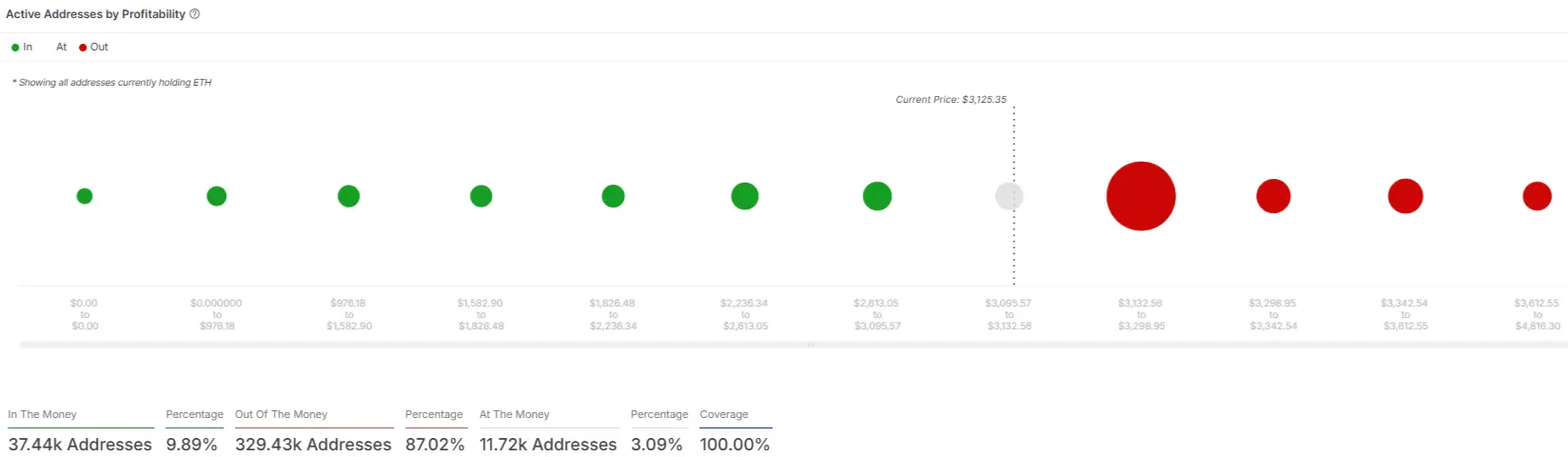

Ethereum’s present value stage, hovering round $3,119, paints a fancy image for merchants and traders. In line with the profitability chart, 87.02% of addresses holding ETH tokens are “out of the cash,” indicating that almost all holders are experiencing unrealized losses on the present value.

Solely 9.89% of addresses are “within the cash,” signaling a steep uphill battle for bulls to regain momentum. In the meantime, 3.09% of addresses are “on the cash,” reflecting the fragile equilibrium available in the market. This stark disparity underscores the significance of the $3,000 assist zone, as its failure might intensify bearish sentiment, driving costs towards the subsequent key Fibonacci retracement stage of $2,927.

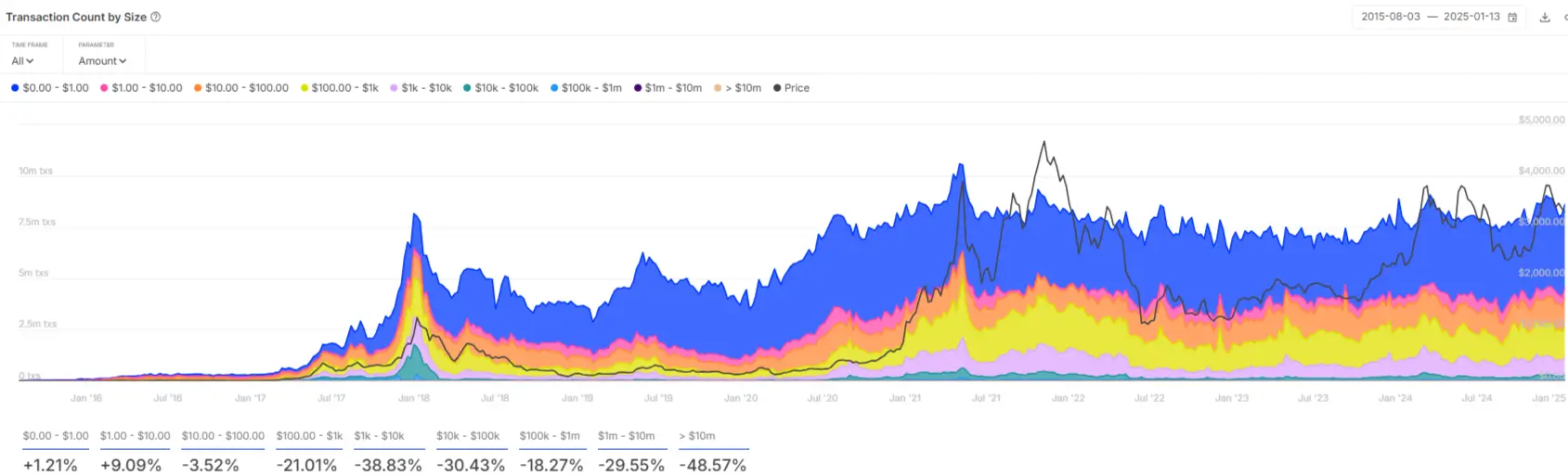

Conversely, a decisive push above the $3,132-$3,500 resistance vary would possible present much-needed aid for struggling traders. Alternatively, the transaction rely information by measurement reveals additional insights into market habits. Small-scale transactions underneath $1,000 have seen marginal development, with will increase of +1.21% and +9.09%, respectively, for transactions underneath $1 and between $1 and $10.

Nonetheless, bigger transactions are on a steep decline. As an illustration:

- Transactions between $10,000 and $100,000 have dropped by -30.43%.

- Transactions within the $1 million-$10 million vary have plummeted by -29.55%.

- Institutional-sized transactions exceeding $10 million have taken the toughest hit, declining by -48.57%.

This downward pattern in large-scale transactions suggests waning confidence amongst institutional gamers, additional weighing the cryptocurrency’s short-term outlook.

Additionally Learn: AAVE Value Targets $400 as Whale Exercise Surges